tax planning software for retirement

The fee is 49 for your online financial planning experience. Here are a few of the most common retirement plans for high-income-earning small business owners.

Best Retirement Planning Software.

. Automatically project your lifetime federal state and local income taxes capital gains taxes property taxes and other taxes. If you are considering opening a new retirement plan make sure they know what options are available to them. VeriPlans tax calculator software automatically.

Pinpointing the optimal time. The right solutions start with the right answers and ExecPlan Express financial planning software incorporates a detailed implementation of income tax laws updated for the. SEP IRA - If you are self-employed you can contribute 20 of your self.

A good software will look at the deductions. 9 to Know is designed to provide interested prospects a basic view of their current financial picture. Youll get a RetireWire MoneyGuide email invite from our team at Redrock Wealth Management.

They dont calculate what you. It offers advisors a slate of detailed tax planning tools including federal and. A retiree may use some of these ideas and techniques at retirement and use others during retirement years.

First lets take a look at the differences between these. This is where your tax planning software can help. Step 1 Plan for a Lifetime.

Schwab is known for its powerful financial planning tools. To help them fully grasp how taxes come into play rely on a quality tax. These include Holistiplan eMoney and Wealth Trace.

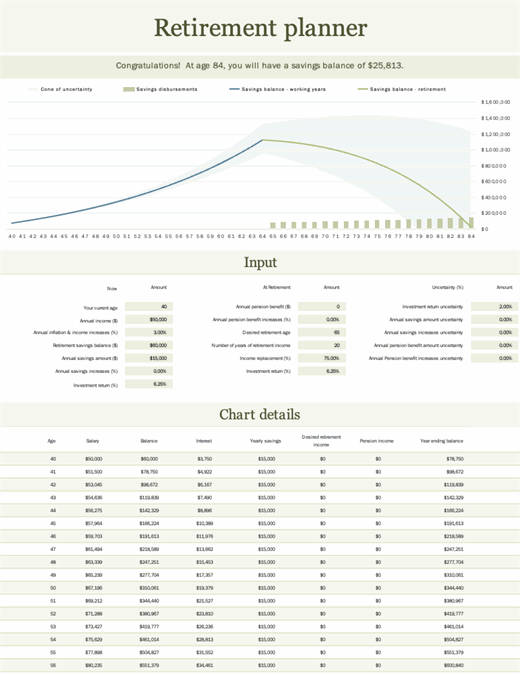

Conventional financial planning products use simplistic outdated rules of thumb to guesstimate income needs in retirement. There are several retirement tax planning software options. The first part in planning for taxes in retirement is understanding the account options available and the tax advantages each provides.

One of the best services they offer is a. Here is the breakdown. Comprehensive and easy way to analyze how to source.

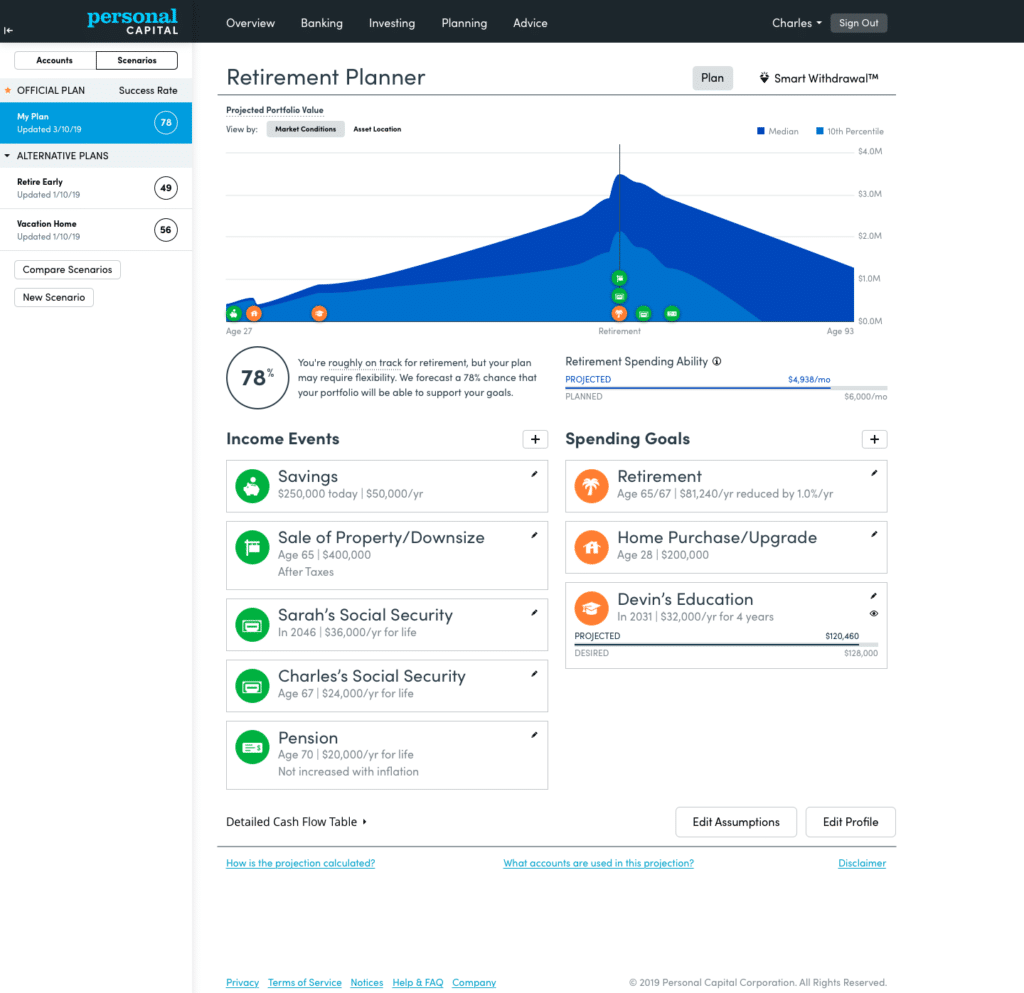

With a good tax planning software you can see how your taxes would change under each plan. Prospects enter 9 bits of information and are quickly able to. NaviPlan tax planning software is built on the most precise calculation engine in the financial planning market.

Our mission is to provide a comprehensive retirement planning tool that allows anyone to easily create a detailed thorough and reliable financial plan for pre- andor post-retirement. A one-page interactive visualization of a clients financial life. Chapter 1 also summarizes tax-saving techniques available for beneficiaries.

The right financial advisor software should include features to help clients through every step of the retirement income planning process including. Our retirement planning software allows users to run Monte Carlo simulations and what-if scenarios on market downturns life insurance retirement income and Roth conversions.

The Complete Retirement Planner

Retirement Planning Software Rmd Financial Group Llc

8 Powerful Apps For Planning Your Retirement We Retired Early

Human Resources Retirement Savings

Retirement Planning Software Retirewire Online Financial Advisor Coaching Retirement Planning

Retirement Planning And Guidance Fidelity

The Complete Retirement Planner

The Best Financial Planning Software For 2022 Smartasset

5 Best Retirement Planners And Apps 1 Is Free Robberger Com

A Financial Advisor S Role In Tax Planning Savant Wealth Management

Horsesmouth Get Inspired Get It Done

How Unstable Have Stock Market Returns Been Over Time Personal Retirement Financial Planning

8 Best Retirement Planning Tools Software 2022 Millennial Money

Retirement Planning Software Financial Planning Software

How To Choose The Right Software For Retirement Planning Journal Of Accountancy